Improving access to the private rented sector for low-income households

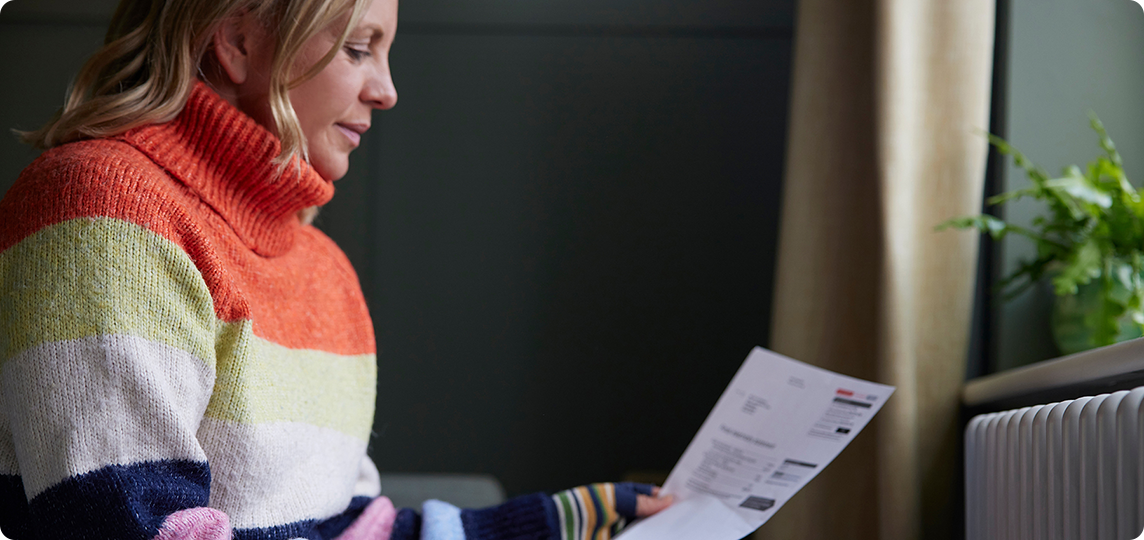

Since I joined The Dispute Service (TDS) 11 years ago, I have increasingly witnessed homeless people, care leavers and ex-offenders being housed in the private rented sector. One of the key barriers to access good quality private rented housing is the requirement to provide a cash security deposit.

However, since the pandemic, the process became much more difficult. On one side, we have households struggling financially (ex-offenders, homeless, care leavers). On another, we have landlords who require additional financial safeguards to rent to the mentioned group.

However, since the pandemic, the process became much more difficult. On one side, we have households struggling financially (ex-offenders, homeless, care leavers). On another, we have landlords who require additional financial safeguards to rent to the mentioned group.

Many local authorities offer a range of incentives to private landlords to encourage them to accept low-income tenants. This is done by either paying rent deposit to the private landlord on behalf of the tenant or by providing the landlord with a deposit bond/guarantee, local authorities need to step in to cover entry costs required.

Charities and organisations across the UK have long argued in favor of a publicly funded National Deposit Scheme to help overcome this barrier. However, to date, governments across the UK have not risen to the challenge of funding such a service.

New National Deposit Bond Scheme

At the Brighter Future Conference, together with Ben Beadle, Chief Executive of the National Residential Landlords Association (NRLA), I will talk about the FairBonds scheme, a voluntary & not-for-profit National Deposit Bond Scheme to assist low-income households moving into the PRS.

I believe FairBonds can offer a quicker and leaner process for private landlords, tenants and local authorities. Developed by TDS, NRLA, Crisis and Home Connections, the scheme brings together years of expertise in housing and in deposits management.

The scheme will reduce the need for local authorities to pay upfront cash deposits or administer their own schemes, resulting in reduced administration costs.

Through the partnership between NRLA, Home Connections and FairBonds, more properties from private sector landlords will be advertised via Home Connections national mobility scheme, Homefinder UK. The commitment from private landlords to accept a FairBond instead of an upfront cash deposit will lead to more supported moves.

Looking ahead, could there be a publicly funded solution? Possibly. FairBonds will continue to advocate for national funding to support such scheme. Through the operation of the voluntary scheme, which requires only a small admin fee per FairBond registered, we will provide clear evidence to policy makers on the efficacy and value for money of this type of initiative.

I am looking forward to discussing the scheme in detail during the Brighter Future Conference on 14th of October and it will be notably insightful to hear from you on how you believe such a scheme can help you offer better housing options for those in need.

Steve Harriott

Chief Executive of The Tenancy Deposit Scheme